Fabulous Tips About How To Buy High Yield Corporate Bonds

You can purchase government bonds like u.s.

How to buy high yield corporate bonds. Alternatively, you can invest in. Ushy has an expense ratio of. Goldman sachs access hi yld.

The upside on the laredo '25 bond was limited, however, as the bond was callable at a price of 104.75 beginning january 15, 2022. May provide enhanced income compared to traditional u.s. Xtrackers low beta high yield bond etf.

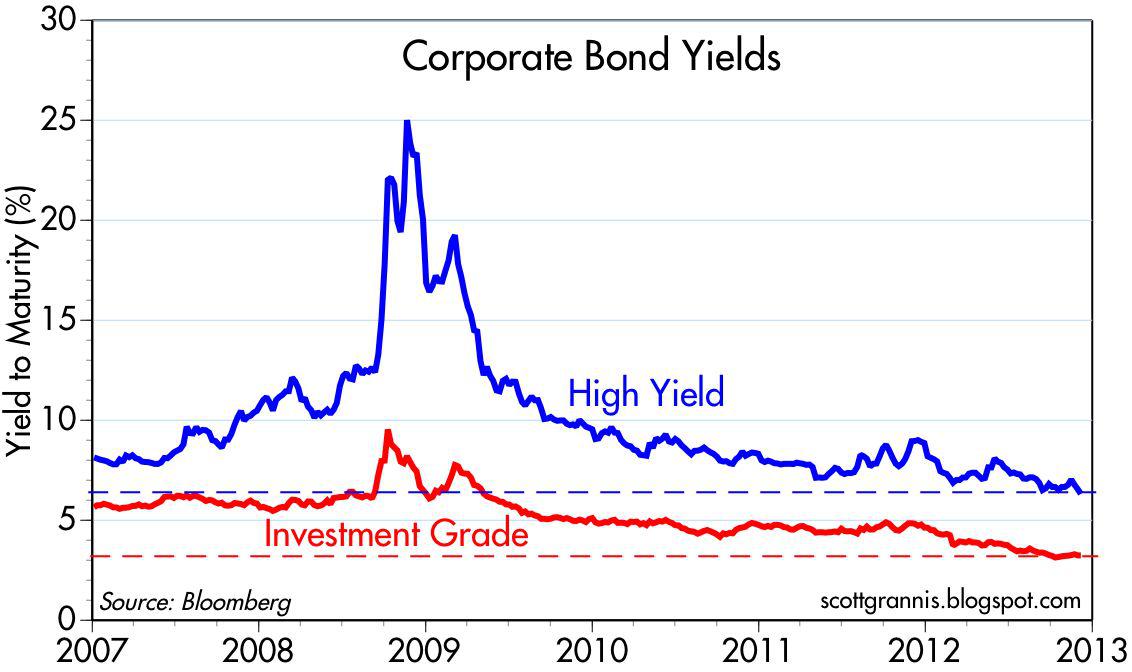

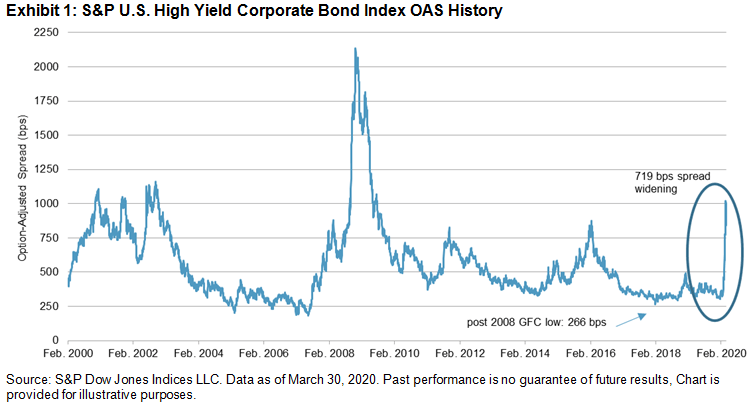

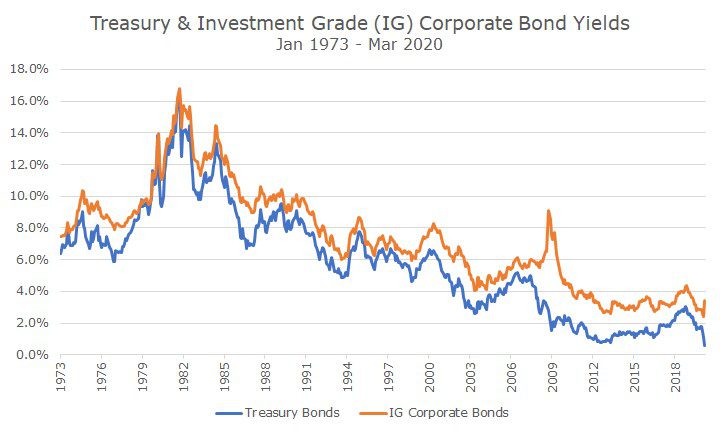

As of wednesday, the s&p us high yield corporate bond index is down 11%, the s&p's investment grade corporate bond index is down 14.5%, and the ishares jp morgan usd. High yield corporate bonds, or junk bonds, are bought in the same method as any other corporate bond. Treasury bonds through a broker or directly through treasury direct.

A high yield bond—sometimes called a junk bond—is a type of bond with a higher risk of default than government bonds or investment grade corporate bonds. Xtrackers usd high yield corp bd etf. As noted above, treasury bonds are issued in increments of.

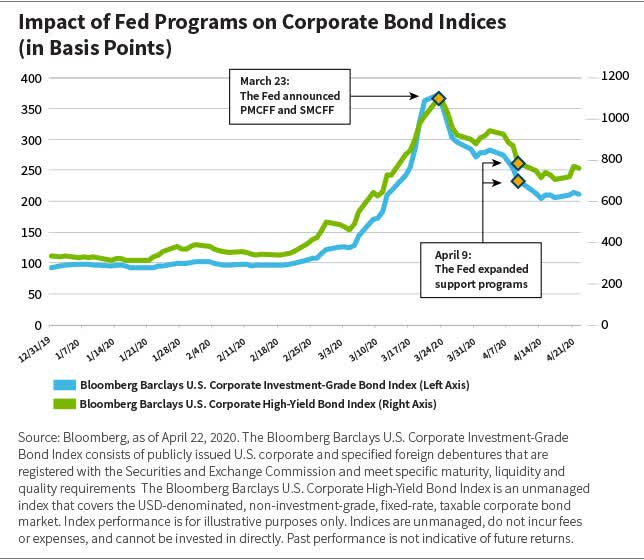

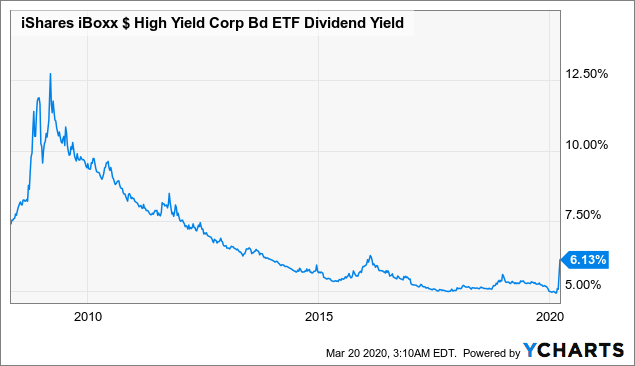

In addition, the fed stepped up its buying of junk bonds, purchasing $331 million worth of the ishares iboxx high yield corporate bond etf, a move up from june's buying of $274.6 million. Ishares bb rated corporate bond etf. Investing in high yield bonds at fidelity.

With limited upside remaining and a greater number of. Corporate bonds are debt obligations issued by companies looking to raise capital. But because the risk of default is high for companies with low credit.

When you purchase a corporate bond, you are in effect lending money to the corporation. If you’re looking for investments with high. High yield corporate bonds by selling monthly covered call.

Place limits and price points when buying junk bonds wi. The fund is sponsored by invesco. Here are the best high yield bond etfs.

8 hours agoishares broad usd high yield corporate bond etf has $8.31 billion in assets, ishares iboxx high yield corporate bond etf has $12.59 billion. When companies with a greater estimated default risk.

:max_bytes(150000):strip_icc()/JNK_HYG_USHY_SPX_chart-356eb8eeccbb4597922a81feca5f3d20.png)

/dotdash_Final_Everything_You_Need_to_Know_About_Junk_Bonds_Dec_2020-01-5306bf5871c8424bacc317dd8bef5c90.jpg)